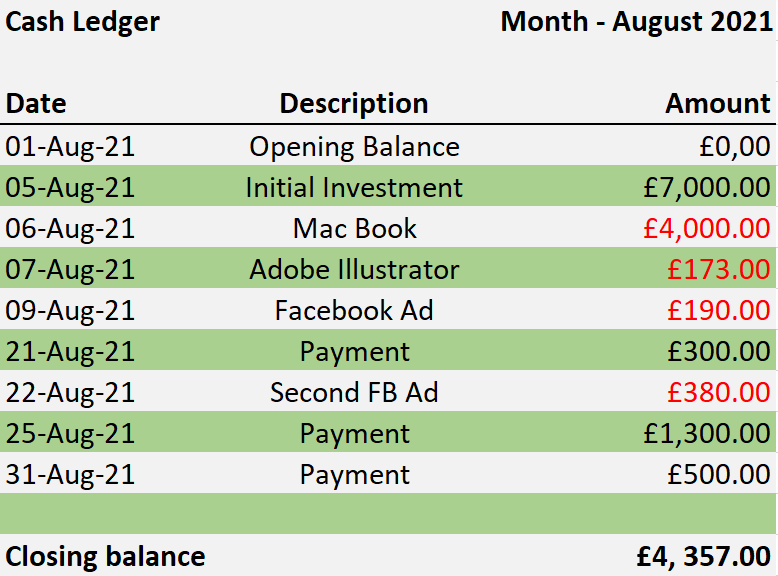

Bookkeepers use two kinds of journals to track the activity: the Cash Disbursements and Cash Receipts.Ĭash covers both physical and electronic money (such as transferred funds). Here, you record each transaction whenever cash changes hands.Įach business transaction passes through the Cash account.

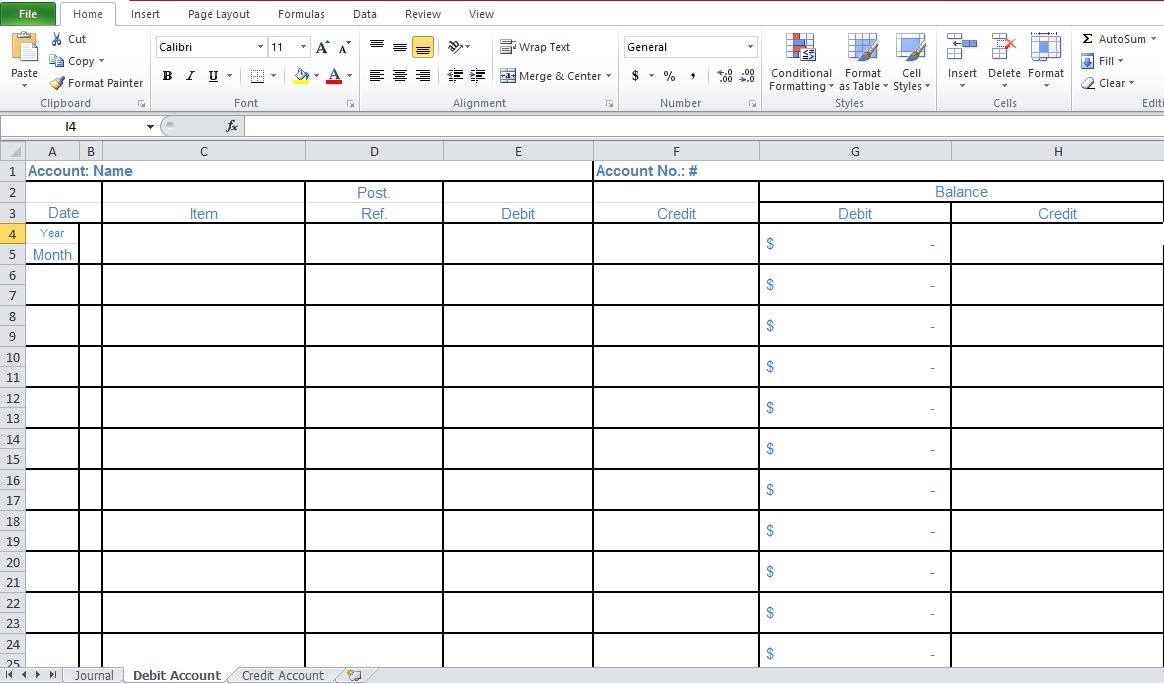

If you’re doing simple bookkeeping for a small business or you’re operating a one-person business, applying the cash basis of accounting is ideal. Bookkeeping software, such as QuickBooks, uses the double-entry system. In this system, each transaction has at least two entries: debit and credit. This works for any business size with complex transactions. The double-entry system is the second type of bookkeeping. RELATED: 9 Recommended Books To Read Before Starting A Bookkeeping Business 5. Bank Statements – The documentation you use to check transactions to avoid error in the journal entries.Cash Sales Journal – Where you record the business’ revenues.Cash Disbursements Journal – Where you record the expenses the business pays for.The following documentation also comes with this type of bookkeeping: In single-entry bookkeeping, you record earnings and expenses upon incurring them. This works for sole proprietors and small business owners who deal with minimal and uncomplicated transactions. The single-entry system is one of the two main types of bookkeeping. Owners’ equity monitors the amount the owners and investors put into their business. In the Balance Sheet, the equity accounts cover all the claims they have over the company.Įquity includes the investment the business owner/s put in as well as the other investments the company made. EquityĮquity refers to the ownership of the business owners and investors in the company. Liabilities are also part of the Balance Sheet. These loans are usually when the company borrows money to buy property, equipment, or vehicles necessary to operate. Loans Payable – This account keeps track of the current and non-current loans the business incurred.Bookkeepers need to work diligently to pay suppliers on time or even earlier, which can qualify the business for a discount. Accounts Payable – This is what the business owes to its suppliers.This includes short- and long-term debts: accounts payable and loans payable (current and non-current):

Fixed Assets (i.e., properties and equipment).

#Basic bookkeeping for small business manual#

Previously recorded inventory should be regularly reviewed against the current inventory on hand through manual counting.

#Basic bookkeeping for small business update#

Bookkeepers carefully track and update this to ensure they send accurate invoices or bills on time. Accounts Receivable – This is the money to be collected from customers for the products they purchase and services they purchase or avail.Marketable Securities Account – This covers all cash equivalents such as government or corporate bonds.Cash Account – This is the cash on hand and cash on banks.Intangible assets include royalty and goodwill, while tangible assets include the following: Tangible and intangible assets are part of the Balance Sheet. Start your bookkeeping career the right way with these nine bookkeeping basics for beginners! Bookkeeping Basics 101: 9 Bookkeeping Basics for Beginners 1.

0 kommentar(er)

0 kommentar(er)